Enterprise Grade Tokenization-As-A-Service and Investment Platform

An Enterprise class Tokenization-As-Service of Real Estate Assets and Investment platform providing ease of tokenization and investment through blockchain technology innovation for all types of real estate assets.

Residential Real Estate

Commercial Real Estate

Land & Acreages Real Estate

Trophy Real Estate

Luxury Real Estate

Property Developments

Unified Tech and Compliance Platform for Streamlined Tokenization and Investment Success

RealTokenize offers a cutting-edge platform for tokenizing real estate, featuring an integrated transfer agent for seamless asset transfers, an automated compliance manager to ensure regulatory adherence, and access to a global legal and financial network. Our user-friendly UI/UX delivers an exceptional experience, while primary and secondary market trading ensures liquidity revolutionizing real estate investments. Robust and advanced features safeguards every transaction, offering peace of mind and confidence in every trade.

Key Features of the RealTokenize Platform

- Advanced Tokenization Platform

- Best-in-Class Transfer Agent

- Automated Compliance Manager

- Primary and Secondary Market Trading

- Global Legal and Financial Network

- Best-in-Class UI/UX

- Robust Security Features

- Investor Marketplace for Buying Real Estate Tokens

Unlocking Prime Real Estate Frontiers Ready for Tokenization

01

Residential Real Estate

Realtokenize simplifies tokenization & investing in housing developments, condos, and apartment buildings, making it accessible for all types of investors.

03

Commercial Properties

Tokenize your office buildings, shopping, centers or industrial properties to attract more investors and manage assets more efficiently.

02

Real Estate Investment Trusts (REITs)

Tokenizing REITs allows for more flexible, inclusive investment options through fractional ownership.

04

Land Developments

Easily raise funds for new projects like subdivisions or mixed-use developments through tokenization, expanding financial opportunities and asset liquidity.

01

Residential Real Estate

Realtokenize simplifies tokenization & investing in housing developments, condos, and apartment buildings, making it accessible for all types of investors.

02

Real Estate Investment Trusts (REITs)

Tokenizing REITs allows for more flexible, inclusive investment options through fractional ownership.

03

Commercial Properties

Tokenize your office buildings, shopping, centers or industrial properties to attract more investors and manage assets more efficiently.

04

Land Developments

Easily raise funds for new projects like subdivisions or mixed-use developments through tokenization, expanding financial opportunities and asset liquidity.

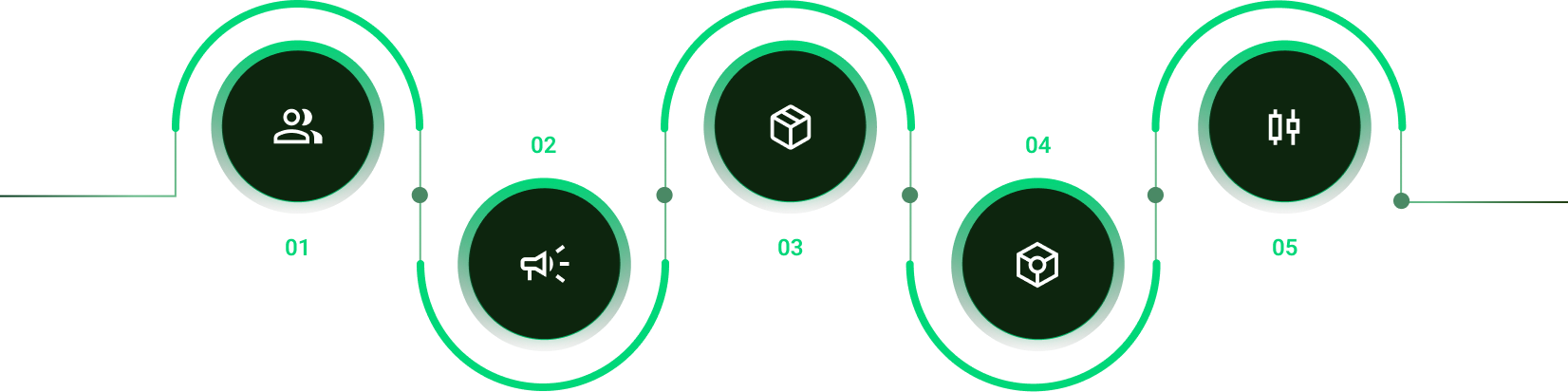

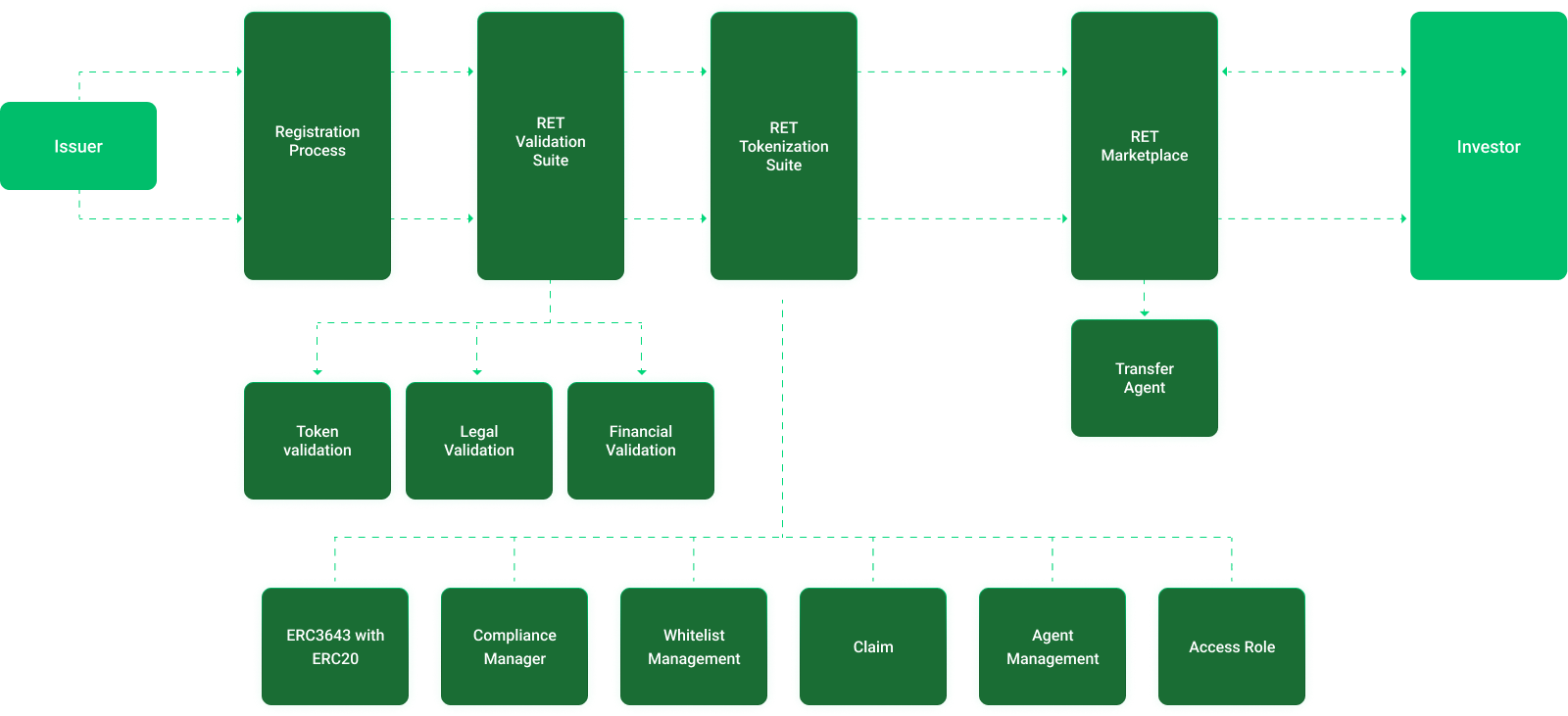

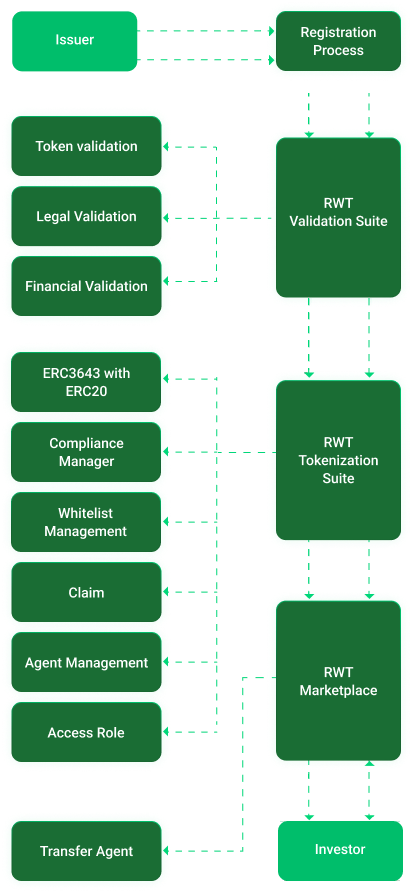

RealTokenize Tokenization Lifecycle

RealTokenize Empowering Institutions and Investors with Seamless Real Estate Tokenization Benefits

RealTokenize offers institutions the ability to streamline capital raising and asset management, while providing investors with access to fractional ownership, global real estate markets, and secure, transparent investment options.

Tokenize All Types of Real Estate

Comprehensive Platform to Tokenize Residential, Commercial, Industrial, Land, Trophy, Luxury Properties and REIT’s with ease.

Faster Transaction Settlements

Trade & Settle Tokenized real estate in near real-time compared to traditional real estate deals, which can take weeks or months.

Global Investor Access

Access a global pool of investors without geographical limitations, enhancing market exposure and increasing investment opportunities.

Cost Efficiency

Reduce the need for intermediaries like brokers, reducing administrative and transaction costs by leveraging RealTokenize Protocol

Efficient Fundraising

Efficiently Raise capital by tapping into retail and institutional investors without going through traditional financial institutions.

Access to DeFi and Yield Opportunities

Integrate with DEFI protocols, allowing issuers and investors to access liquidity pools, staking, and other yield-generating opportunities.

Fractional Ownership

Unlock access to premium real estate with fractional ownership, making high-value property investments more affordable and within reach.

Low Entry Barriers

Fractionalization lowers entry barriers, letting investors access real estate with less capital and enabling retail participation alongside institutions.

Global Market Access

Access tokenized real estate opportunities without being restricted by geographical barriers or local market entry limitations.

Access to High-Yield Opportunities

Participate in high-yield opportunities in commercial, residential, industrial, short-term rentals and development & others.

Diversification Opportunities

Diversify portfolios by investing in multiple properties across different geographic locations and asset types, reducing risk exposure.

Integration with DEFI

Investors can use tokenized real estate assets as collateral in DEFI protocols, providing new avenues for borrowing, lending, and yield generation.

2024

Real Estate Tokenization Market

$3.5 billion

By 2033

Real Estate Tokenization Market

$19.4 Billion

CAGR 21%

Secure, Transparent and Scalable Platform Transforming Real Estate Ownership

RealTokenize is transforming real estate tokenization and investment by harnessing the power of distributed ledger technology, making global real estate more efficient, accessible, and transparent.

RealTokenize Learning Hub

Discover the RealTokenize Learning Hub with Blogs, Spotlight Achievements, Tech Insights, and Key Announcements.

Blogs and Articles

Spot Light and

Achievements

Technological Insights

Announcements